ABOUT

Established in 1999, PAX Holdings Ltd is a Family Office whose investment journey began with pioneering early-stage investments in the digital financial services sector.

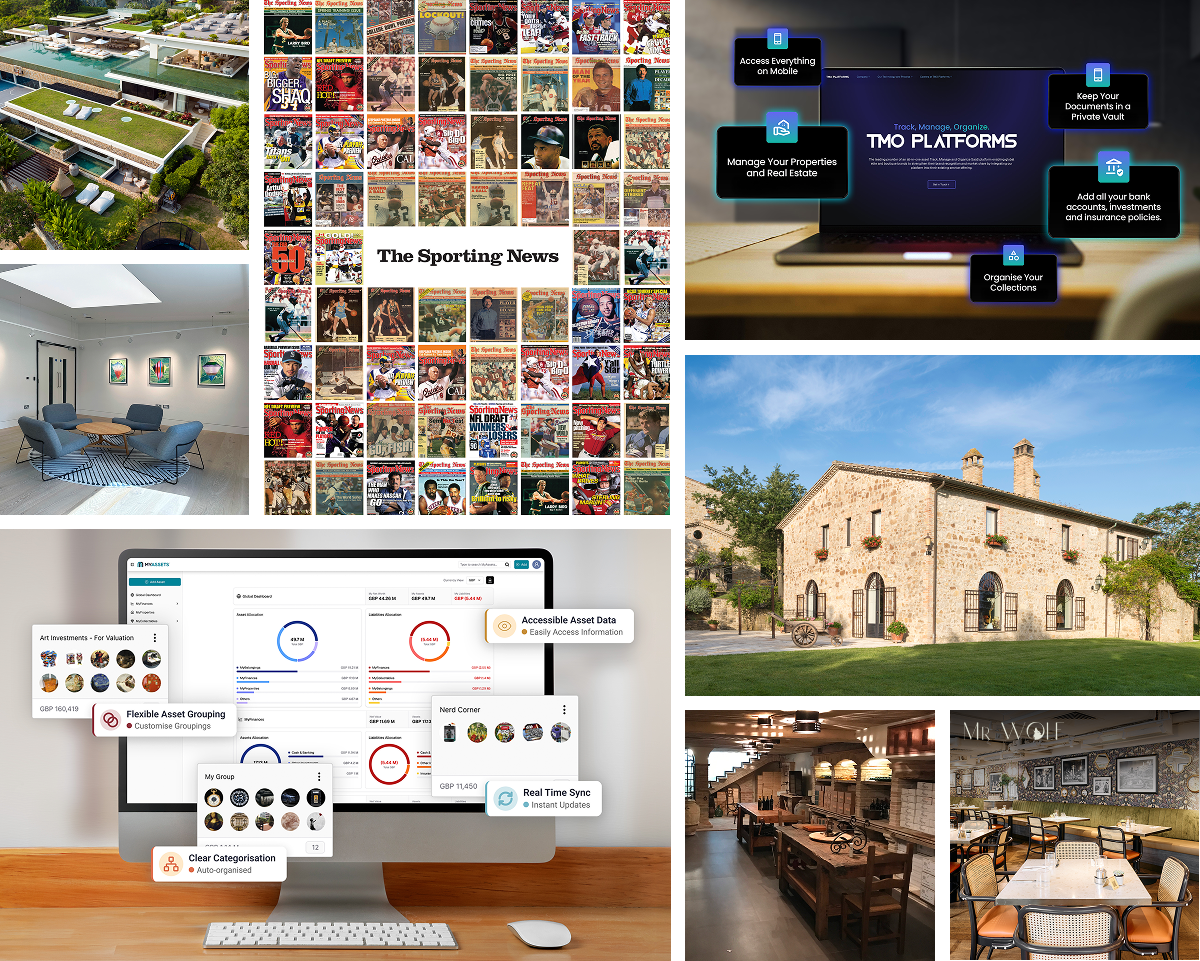

PAX invests in leisure and gaming, leisure-related real estate, gaming technology, social media marketing and messenger services, behavioral change services, digital consumer retailing, asset management platforms and a wide spectrum of businesses in the wine and spirits sector.

Its Principals have been advising numerous transactions within the leisure and gaming sector and participates as direct investors in multiple opportunities since 2004.

ABOUT

Established in 1999, PAX Holdings Ltd is a Family Office whose investment journey began with pioneering early-stage investments in the digital financial services sector.

PAX invests in leisure and gaming, leisure-related real estate, gaming technology, social media marketing and messenger services, behavioral change services, digital consumer retailing, asset management platforms and a wide spectrum of businesses in the wine and spirits sector.

Its Principals have been advising numerous transactions within the leisure and gaming sector and participates as direct investors in multiple opportunities since 2004.

INVESTING & SERVICES

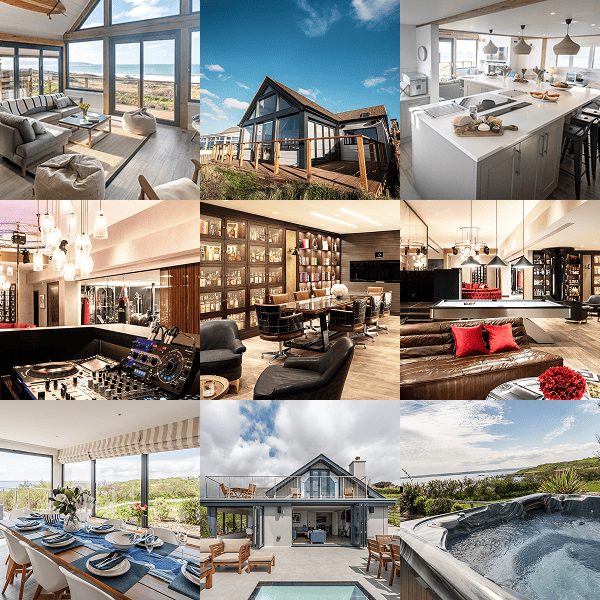

Pax Properties

Pax Properties is a leading real estate management company specialising in the acquisition, development, and management of residential and commercial properties across the UK. The company is committed to creating long-term value and sustainable growth through expertly managed assets and exceptional client service.

OUR CLIENTS

PAX has been serving as an advisor to investors and on various transactions, while also investing directly in a diverse portfolio of companies. A selection of these is presented below.

THE TEAM

SPONSORSHIP & CHARITABLE DONATIONS

Pax also actively supports educational and sporting charities and clubs, in particular The Best Gift Foundation, the Matchroom Boxing Foundation and Valley R.F.C. Hong Kong.

CONTACT US

2nd Floor, RAFA House,91 Bucks Road, Douglas,Isle of Man IM1 3DA

Unit 502, 5th Floor, 70 Queen’s Road Central, Central, Hong Kong

Uplands, Oakfield Road,London SW19 5PL

Mezzanine Floor, Hormuz Grand Hotel Al Matar Street, Muscat - Oman P.O Box 395, PC 118 Muscat

Mill Mall, Suite 6, Wickhams Cay 1, P.O. Box 3085, Road Town, Tortola, British Virgin Islands

©2025 Pax Holdings All Rights Reserved